In modern times, many tasks involved in running a business have gone digital. These tasks include sending quotes and invoices to customers, receiving and making digital payments, tracking cash flow, and simplifying tax processes. Cloud-based accounting software is designed to handle all these tasks for businesses. This article aims to assess the top cloud-based accounting software options, comparing their features and prices to help readers decide which one will be the most advantageous for their business.

What is Cloud-Based Accounting Software?

Cloud-based accounting software, at its most basic, is business accounting software that is stored on distant servers and accessed via the internet. Users view the software through a web browser or specialized app rather than having it locally installed on their computer. This indicates that all financial information is kept on servers controlled and managed by the software provider, which are kept remotely.

Top Cloud-Based Accounting Software Solutions

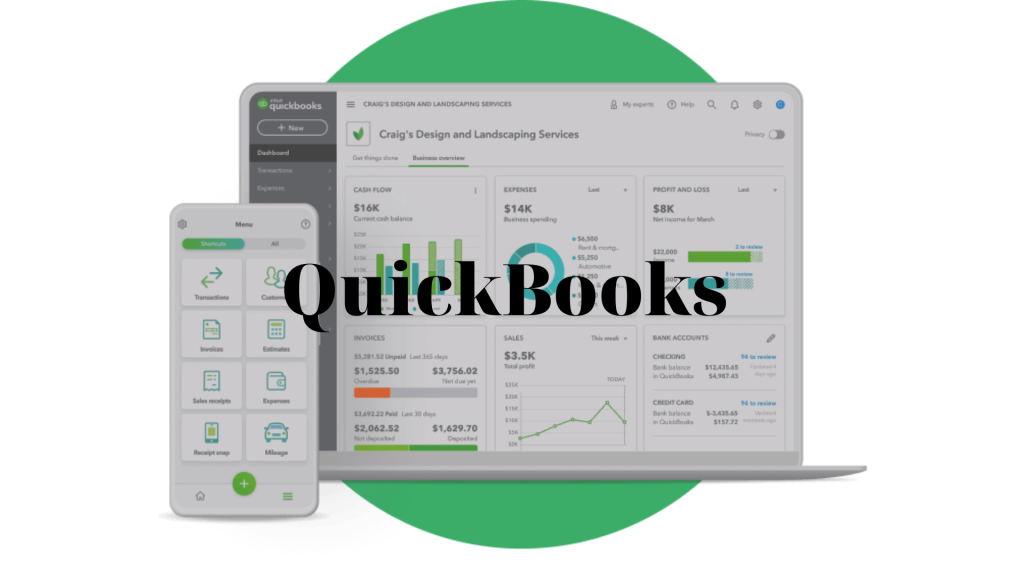

1. QuickBooks

One of the most widely used cloud-based accounting software programs available right now is QuickBooks Online. It integrates with numerous third-party apps and provides a range of functions, such as invoicing, expense tracking, and report generation.

Key Features:

- Tracking income and expenses

- Maximizing tax deductions

- Monitoring inventories, project profitability, and employee work hours.

- Add-on payroll features, invoicing

- Financial reporting.

Based on these features, QuickBooks is considered one of the best cloud accounting software options for small businesses.

QuickBooks offers a free trial for 30 days, and users can also avail 50% off for the first three months on certain plans.

- Self-employed: $15 per month

- Simple start: $25 per month

- Essentials: $50 per month

- Plus: $80 per month

- Advanced: $180 per month

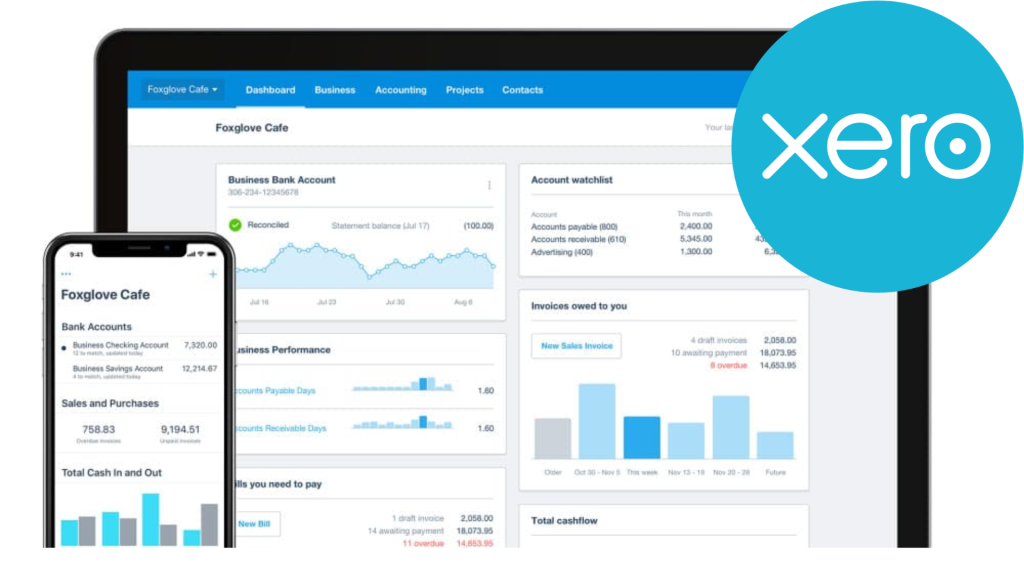

2. Xero

Another well-liked cloud-based bookkeeping software program is Xero. While it has many of the same features as QuickBooks Online, it also has a number of extra features like job tracking and time tracking.

Key Features:

- Track your time and project profitability

- Store your receipts and documents to ease the tax filing process

- Create and share invoices, and maintain a record of invoice history for each customer.

- Financial reporting and analytical tools and integrates with Gusto for payrolls.

Xero is a recommended software for small businesses due to its affordable price plans compared to other alternatives.

Price plans are as follows:

- Early: $5.50 per month

- Growing: $16 per month

- Established: $31 per month

3. FreshBooks

A cloud-based accounting software program made especially for independent contractors and small businesses is called FreshBooks. Along with integration with a variety of third-party apps, it provides tools like time tracking, project management, and invoicing.

Key Features:

- Monitor project profitability, expenses, time, and mileage.

- Provides financial and accounting reports

- Create and send unlimited invoices, estimates

- Payment reminders to clients.

FreshBooks has a mobile application that allows you to manage tasks from anywhere. It is a great option for small businesses due to its affordability, user-friendliness, and variety of features.

FreshBooks offers a 30-day free trial, and you can choose to take advantage of that or receive a 50% discount on each plan for the first three months.

Price plans are as follows:

- Lite: $15 per month

- Plus: $25 per month

- Premium: $50 per month

- Select: Custom pricing

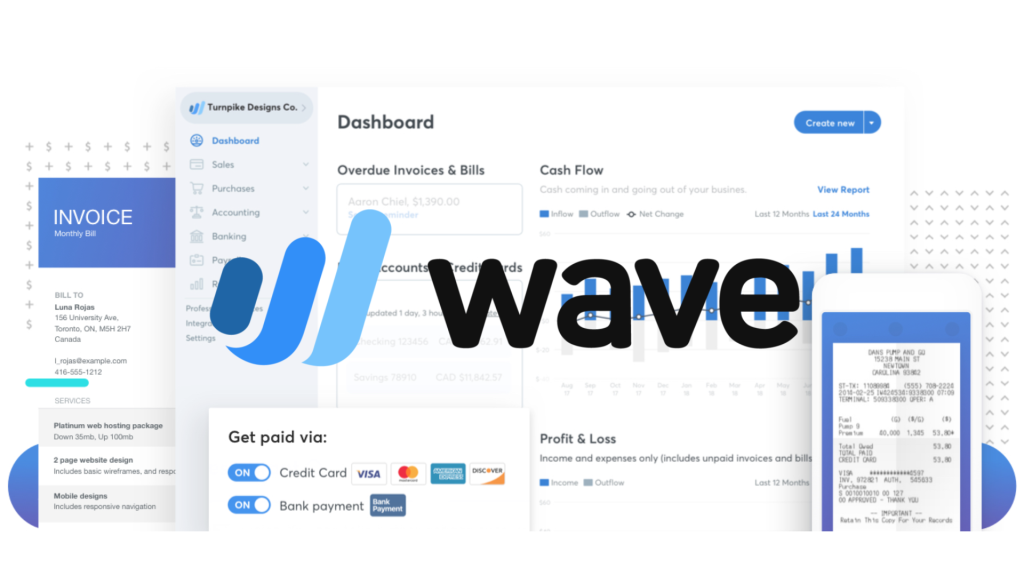

4. Wave

Invoicing, expenditure tracking, and receipt scanning are just a few of the features that Wave’s free cloud-based accounting software solution has to offer. While Wave is free to use, some services, like payroll, are paid-for only.

Key Features:

- Tracks your income, expenses, and sales tax.

- Check your business’s performance and creates reports for overdue invoices, cash flow, profit & loss, and more.

- Enables you to organize your expenses, simplifying the tax process.

Overall, Wave is a reliable and trustworthy software, especially for small business owners, and the fact that it is available for free makes it highly recommended.

Price: Free

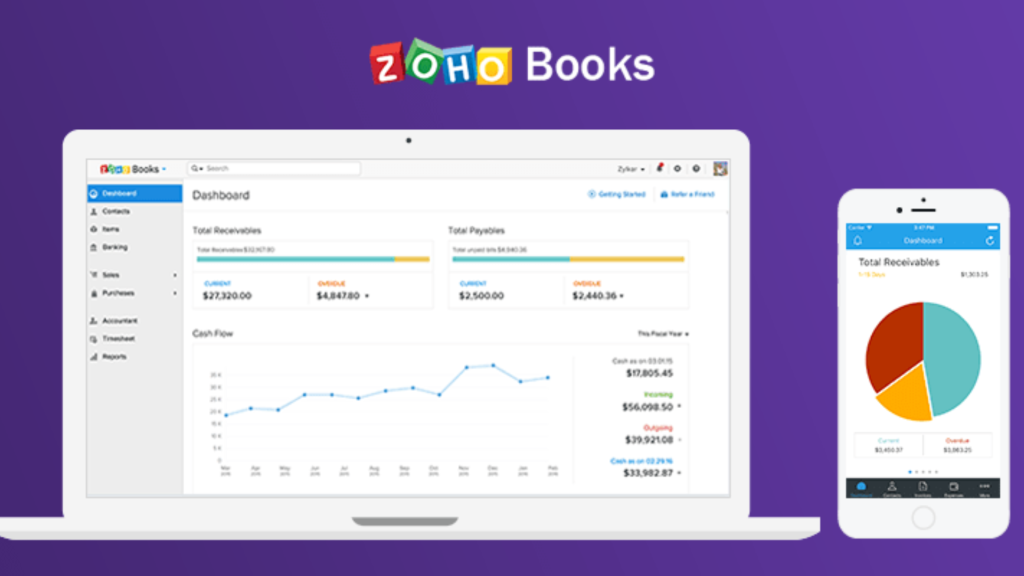

5. Zoho Books

Invoicing, expense tracking, and report generation are among the features offered by the cloud-based accounting program Zoho Books. It is a good option for companies that require these extra features because it also has features like project management and time tracking.

Key Features:

Zoho Books is a cloud-based accounting software that comes with a variety of features. It offers:

- A mobile app for Android and iOS users, multiple language support for invoice creation, recurring invoice automation

- Expense tracking, sales tax tracking, project profitability tracking, and more.

The Premium plan also provides users with a custom domain. Additionally, Zoho Books offers budgeting and reporting tools. The software is highly recommended, particularly for small business owners, and its free version is exceptional, offering invoicing, mileage tracking, reporting, and many other features.

Price:

- Free

- Standard: $20 per organization per month

- Professional: $50 per organization per month

- Premium: $70 per organization per month

Conclusion

Overall, cloud-based accounting software has a number of advantages for companies of all kinds. Businesses can obtain real-time financial data, enhance collaboration and accessibility, and streamline their financial management processes by selecting the appropriate software solution. Businesses can find a software solution that suits their requirements and aids in the achievement of their financial objectives thanks to the wide range of cloud-based accounting software options currently available on the market.